Oroco Announces Significant 3D IP Survey Results

January 27, 2021

VANCOUVER, Canada — (January 27, 2021) Oroco Resource Corp. (TSX-V: OCO, US OTC: ORRCF, BF: OR6) (“Oroco” or “the Company“) is pleased to announce significant results from the deep, three-dimensional, Induced Polarization (“3D IP”) geophysical survey of its Santo Tomas porphyry copper project in Mexico. The survey is now approximately 80% complete, and Oroco has received preliminary inversion data for all stations surveyed to date. The preliminary inversion model has successfully mapped the resistivity and chargeability characteristics along a swath 2.1 km wide by 4.3 km along strike over the South Zone, North Zone and part of the Brasiles Zone. The survey has reached the southern fringe of the prominent Brasiles zone gossans. Geophysical crews have now re-mobilized to complete the planned program and to prepare additional survey lines to enlarge the north and south-east extents of the current survey area. The Company has high confidence in the survey results.

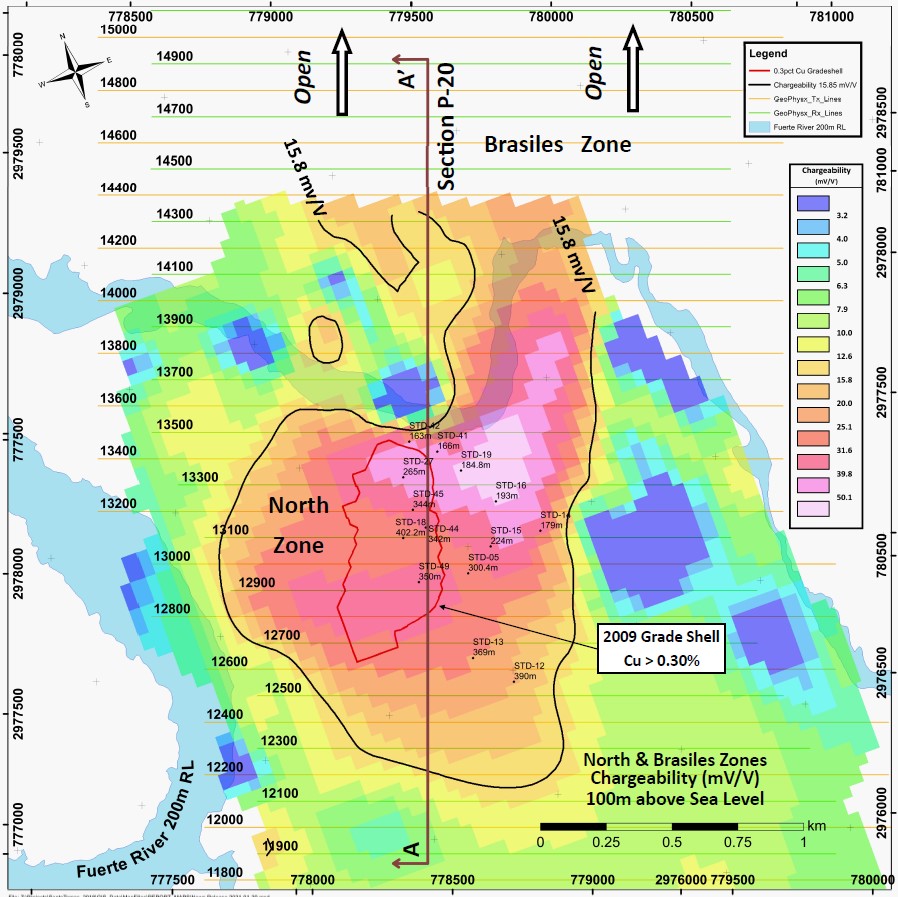

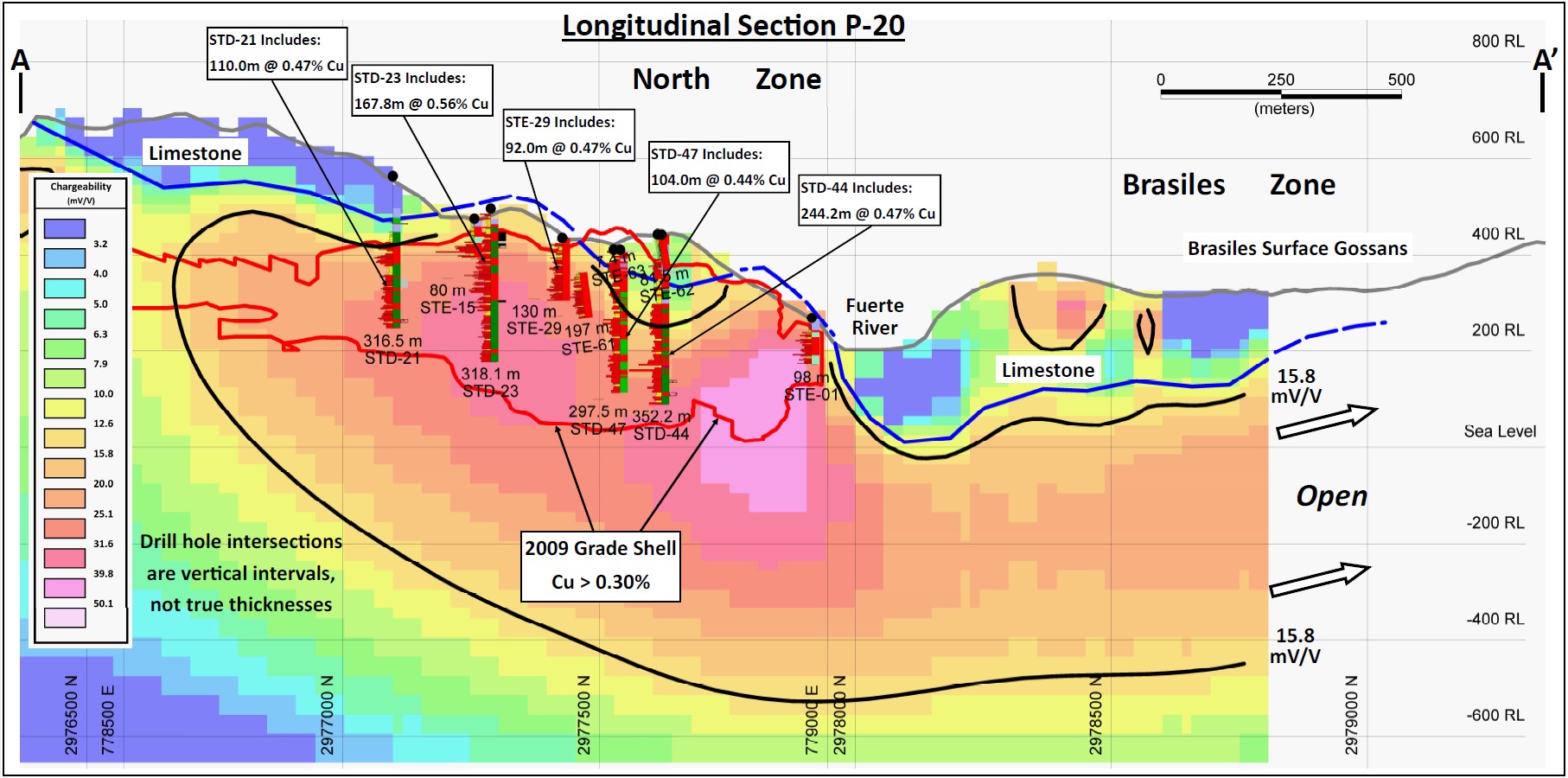

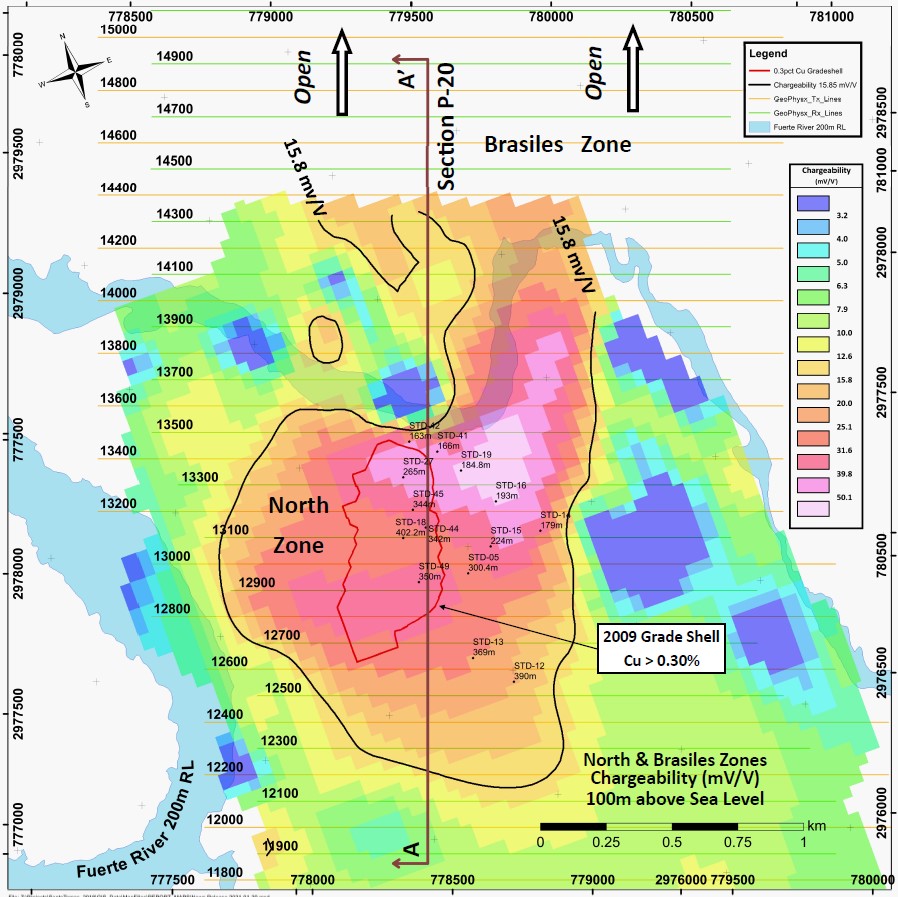

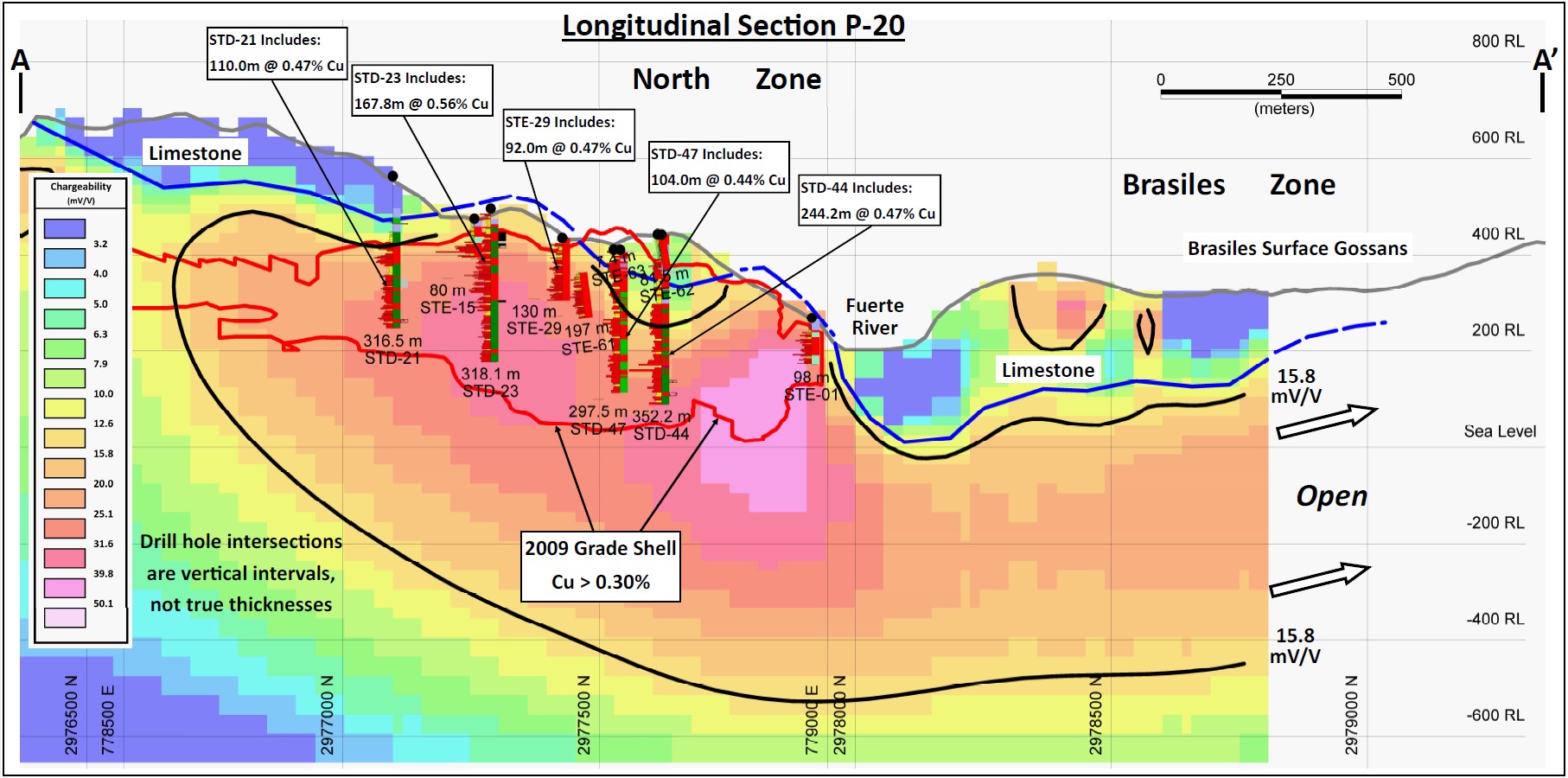

“The preliminary 3D IP inversion modelling has revealed an extensive area of strong chargeability response that encloses the known North Zone deposit and extends beyond the historical drilling to the north, the west and to depth,” said Craig Dalziel, Oroco’s CEO. “The response broadens below the North Zone and extends northward under the Brasiles limestone cap. It is particularly informative and instructive. The first 800 m of modelling of the Brasiles Zone indicates that the North and Brasiles Zones are a contiguous exploration target spanning an average of one kilometer in width and a minimum of two kilometers along strike at the 100 m level elevation. The model remains open to the north. In addition, the survey very importantly demonstrates a strong correlation between the chargeability features and the historical drill results in the South and North Zones as well as significant exploration potential lateral to both. In short, we are extremely pleased with the survey results.”

The preliminary survey data support the following observations:

- Chargeability: The preliminary inversion model clearly identifies the known sulphide mineralization in the central axis areas of the South and North Zone deposits and appears to map this parameter to a depth of approximately 600 meters.

- South Zone: Results show a chargeability-high and resistivity-low response spanning 1,000 m wide by 1,200 m long in horizontal plan view that correlates well with the 10 widely spaced historical drill holes. The response is located below capping volcanic and limestone units and above the contact with an inferred Laramide batholith exposed to the south and west of the South Zone. The responses define a wedge 200 to 400 m thick at the western limit, increasing to 600 m on the surveyed area’s eastern fringe. The responses are open at depth and to the east. The South Zone survey will be extended eastward to better constrain the response.

- North Zone: A 1,000 m wide, strong chargeability-high response is broader than indicated from historical drilling. Notably, the chargeability-high response extends westward of the Company’s 3D geological model of the mineral deposit (the 2009 Gradeshell of Cu > 0.30%), under the concealing limestone cap of the Santo Tomas ridge. Responses extend to the 600 m depth-limit of the 3D IP survey, which is often significantly deeper than the historical drilling. Results also indicate drill targets that lie at a shallower depth below the Santo Tomas ridge than previously estimated.

- North Zone to Brasiles Zone: 3D IP preliminary inversion modelling delineates an NNE striking, west-dipping, chargeability-high response extending from the North Zone to the prominent gossan of the Brasiles Zone. These results demonstrate a shallow-seated, chargeability-high response beneath the Brasiles limestone horizon, similar to the North Zone. (See the attached Figure 2, Longitudinal Section P-20.)

The survey is being undertaken by DIAS Geophysical of Saskatoon, SK (“DIAS“) and utilizes their DIAS32 direct current resistivity and induced polarization (“DCIP“) system using a rolling layout of transmitter locations and a large receiver array that is advancing the survey in successive swaths from the south towards the north. The preliminary inversion information will be subject to additional quality control procedures and certain modelling constraints from Oroco’s 3D geological model when the final data set is obtained. The DIAS Geophysical DCIP system’s novel design has enabled surveying of rugged cliffs and areas that are not otherwise accessible for conventional induced polarization systems. The method also provides coverage to depth and is a robust method for drill targeting.

Mr. Paul McGuigan, P. Geo., of Cambria Geosciences Inc., a Qualified Person under NI 43-101 and a senior consulting geoscientist to the Company, has reviewed and approved the technical disclosures in this news release.

ABOUT OROCO:

The Company holds a net 61.4% interest in the collective 1,172.9 ha core concessions of the Santo Tomas Project in NW Mexico and may increase that majority interest up to an 81.0% interest with a project investment of up to CAD$30 million. The Company also holds a 77.5% interest in 7,807.9 ha of mineral concessions surrounding and adjacent to the core concessions (a total project size of 8,980.8 ha). The Project is situated within the Santo Tomas District, which extends from Santo Tomas up to the Jinchuan Group’s Bahuerachi project, approximately 14 km to the north-east.

Figure 1: Level Plan view at 100 m elevation above RL (“Reference Level,” mean sea level) through the North Zone and southern Brasiles Zone, Santo Tomas project, illustrating the continuity of the preliminary inversion model of chargeability from North Zone to Brasiles Zone.

Figure 2: Longitudinal cross-section A – A’ (refer to Figure 1) through North Zone and southern Brasiles Zone, illustrating the continuity of +15.8 mV/V chargeability response from North Zone to Brasiles. The qualitative concordance between the geological model of the North Zone deposit (the “2009 Gradeshell”), lithologies, historical drill results, and the preliminary inversion model of chargeability is demonstrated.

Santo Tomas hosts a significant copper porphyry deposit defined by prior exploration spanning from 1968 to 1994. The property was tested during that time by over 100 diamond and reverse circulation drill holes, totaling approximately 30,000 meters. Based on data generated by these drill programs, a Prefeasibility Study was completed by Bateman Engineering Inc. in 1994.

The Santo Tomas Project is located within 160 km of the Pacific deep-water port at Topolobampo and is serviced via highway and proximal rail (and parallel corridors of trunk grid power lines and natural gas) through the city of Los Mochis to the northeast and the city of Choix. The property is reached from Choix either by highway and then boat access on the Huites Reservoir, or by way of a 32 km access road which was initially built to service Goldcorp’s El Sauzal Mine in Chihuahua State. The reader is directed to the Oroco’s August, 2019 Technical Report filed on SEDAR, as amended, and on the Company’s website at

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Information

This news release includes certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact included herein, including without limitation, statements relating to future events or achievements of the Company, are forward-looking statements. There can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated or implied in such statements. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these matters. Oroco does not assume any obligation to update the forward-looking statements should they change, except as required by law.