Oroco Announces Receipt of a Draft Technical Report for the Santo Tomas Porphyry Project, Sinaloa, Mexico

June 7, 2019

VANCOUVER, British Columbia – (June 7th, 2019) Oroco Resource Corp. (TSX-V: OCO) (“Oroco” or “the Company”) is pleased to announce the receipt of the initial draft of an Independent Technical Report regarding the Geology, Mineralization, and Exploration of the Santo Tomas Cu-(Mo-Au-Ag) Porphyry Deposit in Sinaloa, Mexico (“the Technical Report”). The Technical Report has been prepared by Dane A. Bridge Consulting Inc. of Calgary, Alberta, for use by the Company and by Altamura Copper Corp. (“Altamura”) for filing as a Technical Report with Canadian securities authorities pursuant to National Instrument 43-101, Standards of Disclosure for Mineral Projects, per the NI 43-101F guidelines.

As announced by the Company on May 7th and May 9th, 2019 regarding a favourable final and written decision of the federal appeal court in Mexico (“the Decision”), which decision is not subject to appeal, the Company may now proceed to register the Santo Tomás Concession titles to Xochipala Gold S.A. de C.V., a subsidiary of Altamura. Oroco currently owns 13.0 percent of Altamura and holds an irrevocable option to acquire the balance of Altamura (refer to the Company’s news release of October 9, 2018). Together with the Decision, the receipt of the Technical Report provides the Company with a current, compliant technical basis upon which to advance the Santo Tomás Project by confirming and extending the technical fundamentals of the Project.

The Decision and the Technical Report represent critical milestones which immediately permit the Company to plan for the near-term perfection of its title over the Project, and to plan and undertake exploration work that will seek to verify and confirm key aspects of a substantial body of historical resource work. The Santo Tomás Cu-Mo-Au-Ag porphyry deposit is now documented along 5 km of strike length, and the Technical Report describes Laramide-age intrusion and hydrothermal mineralization within a large NNE-trending wrench fault and fracture system.

Mr. Craig Dalziel, President of Oroco stated, “We are very pleased to be able to release the Technical Report closely following the appeal court decision in Mexico. The Technical Report clearly provides a basis upon which to advance the Santo Tomás Project and to immediately work to re-rate the Company’s valuation by confirming and extending the technical fundamentals of the Project. The report validates the 10 year process of extensive strategic planning, complicated legal initiatives, complementary land assembly and partnership arrangements, and key technical confirmations which have resulted in an extraordinary opportunity for the Company.”

The Technical Report presents the key findings of historical technical reports, including a 1994 Prefeasibility Study by Bateman Engineering (supported by metallurgical work by Mountain States R&D International, Inc., a resource estimate by Mintec, Inc., and mining and plant estimates by Minetek S.A. de C.V.). The mineral resource estimate prepared by Mintec, Inc. is no longer considered current.1 The cited historical reports were based upon a data set comprised of 90 historical drill holes (reverse circulation and diamond-drill) totaling 21,075 m, with the resulting database now controlled by Oroco.

The historical Bateman Report[1] details several favourable deposit characteristics, including:

- large volume and low strip ratio (Bateman, 1994: greater than 950 million tonnes above a cut-off grade of 0.20% Cu containing approximately 7.4 billion pounds of copper);

- good metallurgy (Mountain State, 1994: mineralized material responded favourably to conventional flotation, common reagents and a 200-mesh grind to produce a 26% to 28% copper concentrate);

- the studies identified no major project risks, and highlight the proximity of the project to substantial local energy and transport infrastructure; and

- substantial exploration potential along a largely underexplored 5km strike length.

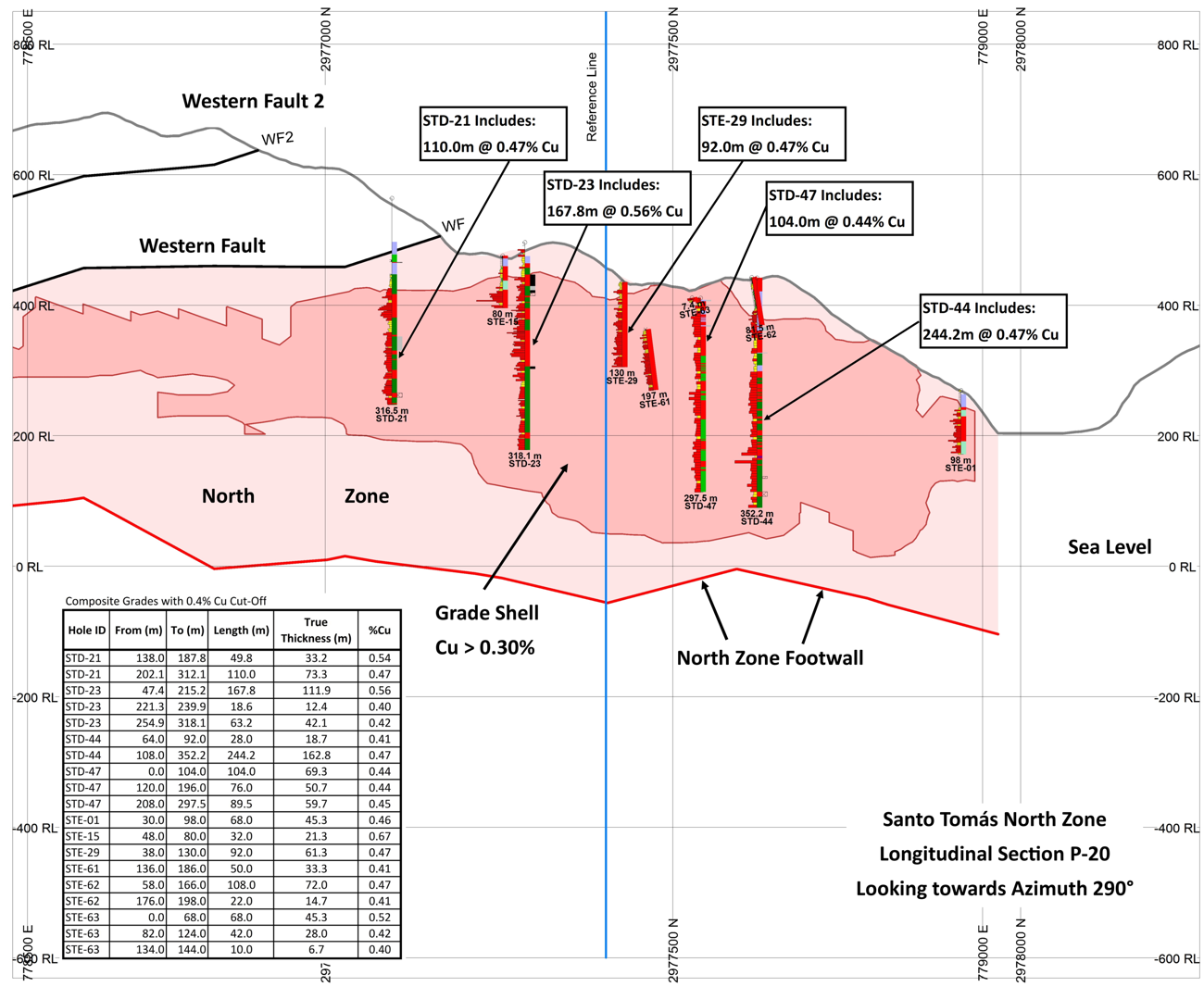

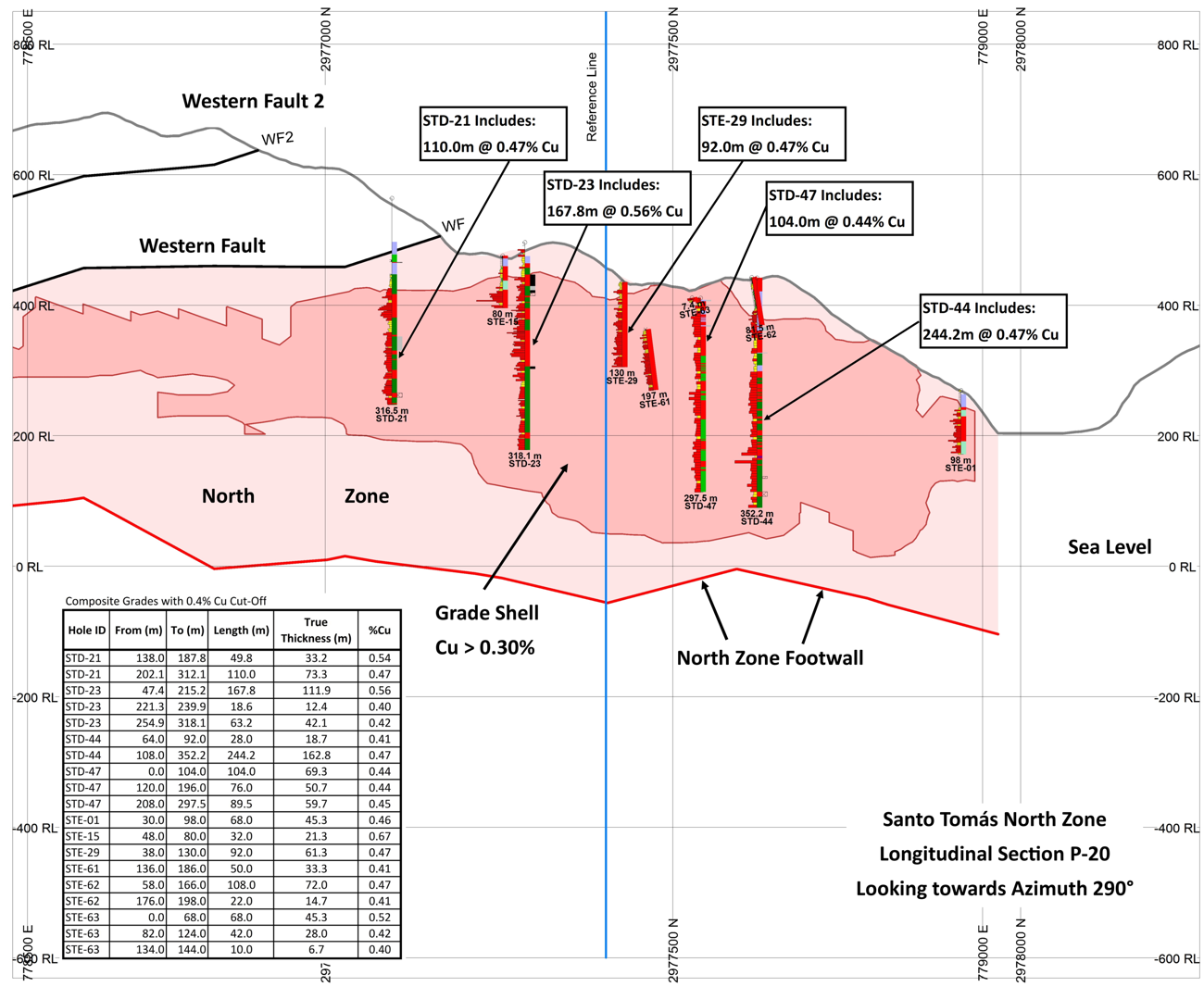

Further, the Technical Report integrates the historical work with a newer satellite digital terrain model, and field geology and structural mapping, part of the exploration work undertaken between 2017 and 2019 by Oroco. Notably, recent structural work by Bridge Consulting corroborates the essential attitude and boundary features of the mineralization as recognized by technical consultants, Cambria (2009) and Thornton (2011), who undertook mineral resource-related work subsequent to the published 1994 Bateman Engineering Prefeasibility study, and who modeled certain key features of the geology and mineralization (refer to the longitudinal section and web link following).

Although these items are strictly historical in nature, they are of significance for near term exploration planning by Oroco. The Technical Report compares an historical block model and grade shell volume for the North Zone prepared by Cambria Geosciences Inc. in 2009 with the conclusions of the 2019 structural mapping, and reports that the Cambria 2009 Grade Shell of mineralized material greater than 0.30% Cu remains valid considering the new structural data, and is acceptable as geological information to confidently recommend a program of concurrent surface geophysical surveys, and confirmation and definition drilling.

Specifically, the Technical Report recommends that initial work at Santo Tomas include 200 line-km of deep 3D Induced Polarization (“3D DCIP”) surveying over the known extent of mineralization, and a drill program of 11 core drill holes (approximately 7,300 m) that will verify and better contextualize the historical drilling at the North Zone. The Company views this initial program of confirmation drilling as critical to providing future validation for a near-surface, higher-grade, low-stripping ratio zone of relevance for a mine scoping study.

Figure: Longitudinal Section through the Santo Tomas North Zone deposit.

The reader is directed to the Oroco website at www.orocoresourcecorp.com for further detail regarding historical work, other longitudinal sections and a plan control map for the above section, together with a Legend for the Sections, and for other graphics representing the principal elements of the historical / geological resource work.

The Technical Report presents a set of vertical Longitudinal Sections that illustrate the potential of the near-surface, higher-grade central portions of the North Zone with strong strike continuity of the mineralization. The Technical Report author recognizes that the Cambria 2009 Grade Shell provides a geological validation for the continuity of mineralization and indicates a target volume of approximately 280 to 315 million tonnes and a target grade of 0.45% to 0.55% copper in a tabular body dipping towards the west at 50º. The fringes of the Cambria 2009 Grade Shell are prospective for exploration step-out drilling, to depth and along strike both to the north and south.

The historical mineral resource estimate1 by Mintec, Inc. (1994) of the North Zone segment of the Santo Tomas deposit requires verification by drilling and by check assay of historical diamond drill core, in order to confirm, and in future, to report a compliant NI 43-101 mineral resource in that area.

The Technical Report notes that the Santo Tomas historical assay results have been the subject of several programs of verification re-assay, each demonstrating a close correlation between the reported assay value and the verification assay value. Notwithstanding, the Company confirms that no recent program of verification of the assays at Santo Tomas has been conducted. The Technical Report concludes that the historical assay results are therefore considered to be geological information, only.

The Company looks forward to releasing the Technical Report to the public.

TECHNICAL REVIEW:

The technical information in this News Release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (“NI 43-101”) and has been reviewed and approved on behalf of the Company by Mr. Dane Bridge, M.Sc., P. Geol., of Dane A. Bridge Consulting Inc., an Independent Qualified Person under NI 43-101.

ABOUT OROCO:

The Company currently holds an irrevocable option to acquire 100 percent of Altamura Copper Corp., a private B.C. company which holds a 50 percent interest in Compañía Minera Ruero, S.A. de C.V., the registered owner of the Santo Tomas concessions, and an option to acquire the other 50 percent interest. The Santo Tomas concessions are a contiguous group of seven mineral concessions located in Sinaloa State, Mexico. Altamura Copper Corp. also holds a 66.7 percent interest in Xochipala Gold, S.A de C.V., the owner of a net 85 percent unregistered contractual interest in the Santo Tomas concessions. The Company and Altamura Copper Corp. are pursuing the registration of the Santo Tomas concessions to Xochipala Gold, S.A. de C.V. for reason of its preferable ownership and investment structure relating to those concessions (see the Company’s most recent MD&A available on SEDAR).

For further information, please contact:

Mr. Craig Dalziel, President and CEO

Oroco Resource Corp.

Tel: 604-688-6200

www.orocoresourcecorp.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Information

This news release includes certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact included herein, including without limitation, statements relating to future events or achievements of the Company, are forward-looking statements. There can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated or implied in such statements. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these matters. Oroco does not assume any obligation to update the forward-looking statements should they change, except as required by law. Readers are also cautioned that this news release includes reference to certain historical reports and studies that are cited in the Technical Report. All of these reports are older than three years before the date of the Technical Report, and were not prepared for Oroco: as such these reports are to be considered geological in nature, and are not to be relied upon or assumed to imply any mineral resource classification(s) with respect to the Santo Tomas Project areas of mineralization.

[1] The conclusion and results of the historical Bateman report are no longer considered current. The Mintec, Inc. resource estimate included in the historical Bateman report (1994) is the last publicly released mineral resource estimate, but utilized a classification scheme that is no longer accepted under NI 43-101. Additionally, the mineral resource estimate is no longer accepted under NI 43-101 standards for reason that it does not conform to the current structural geological model in the Technical Report. A qualified person has not done sufficient work to classify the historical estimate as a current mineral resource or mineral reserve, and it is therefore not considered to be reliable. However, the historical assaying and verification methods were performed within the accepted standards applicable at the time.